Professor Peter Phibbs got a rousing retirement send off from his gig as director of the University of Sydney’s Henry Halloran Trust on Wednesday but he didn’t leave without a few piercing observations on housing and planning.

Even economic and finance commentator Alan Kohler when he appeared on Q+A a few months ago – the man who seems to have a quick and concise answer for near everything – threw up his hands when the topic turned to housing affordability. Nothing works he said. Throw money at first home buyers and the money just goes straight into the pocket of the vendors during the heated auction. Give a tax break on stamp duty. Ditto.

But though housing and the asset bubble that’s infected it, is now a global problem and solutions are so hard to come by there’s absolutely one thing we should not do. And that’s lie about it.

Yet according to Professor Peter Phibbs who’s been a member of the exclusive tell-it-like-it-is contingent on planning and housing for 20 years, that’s exactly what’s been happening. Sure. we expect spin from the powerful property development lobby. They are sophisticated and well-heeled enough to afford the most impressive names of the consultancy buffet. But when the public service joins in it’s time to call them out.

During a rousing send off Wednesday from former students and colleagues alike as he retired from his academic life at the University of Sydney and running the Henry Halloran Trust, Phibbs shared some persuasive views about the way the debate is manipulated not just by faulty logic but by outright lying.

The occasion was the Festival of Urbanism; a panel event to discuss why the public domain and media fail so badly at honest and robust discussion of housing and planning issues.

Moderator Professor Nicole Gurran, who’s the new head of the Halloran Trust managed some “spicy” views as she put it from the audience for panellists Dr Erin Brady deputy director general of the Environment, Planning and Sustainable Development Directorate in the ACT Government, Eliza Owen, CoreLogic Australia’s Head of Research and The Fifth Estate.

Which was to be expected. Housing and planning are among the most contentious issues on the political spectrum given they are key drivers of our quality of life, economic activity, mobility, and “postcode equity”, not to mention environmental outcomes.

As population pressures grow for the best places to live, as house prices keep rising and developers keep encroaching on people’s sense of what their hood is, or should be, planning and housing will also become increasingly politicised and possibly toxic issues. And watch what happens when property prices start to become influenced by climate change.

But planners, those quiet unassuming professionals that deal with these issues and understand the nuanced factors at work are not likely to grab headlines or manage big social media followings, either from supporters or trolls.

There are complex reasons for this and over many years this publication for one has been frustrated at the lack of a clear if not loud voice from this profession, which could be so illuminating on these important issues.

There’s a slow shift under way, especially on housing and the furphy that the high prices are because of a lack of supply. The Reserve Bank of Australia, NSW Planning Minister Rob Stokes, lively urban commentator (and occasional columnist for The Fifth Estate) Tim Williams, and even the former head of planning in NSW Jim Betts now moving to head up the NSW public service, are all starting to question the dominant narrative about supply being the main driver of prices. (Think tax incentives for just one powerful alternative ingredient that could shift pricing, an option now possibly kyboshed for years by the grand failure of the Labor Party to shift the appetite of Australians for genuine reform.)

But to illustrate our prediction that this issue will become more toxic, Betts apparently received disgraceful treatment from The Daily Telegraph for his views to try to unpack the dominant narrative on housing (we can’t confirm the details as we refuse to subscribe) but you can see from this report that Betts told a meeting of the UDIA that we needed a more informed and honest debate. See the social media responses here from Williams and Chris Brown from the Western Sydney Leadership Dialogue.

Supply as the dominant culprit of prices has been debunked many times in these pages, absolutely and conclusively.

And now as the federal government embarks on yet another housing inquiry it’s no surprise that this article Why the RBA is wrong about zoning and house prices. Again is trending right to the top of our hits again.)

Here’s a snippet.

The NSW Minister for Planning and Public Spaces Rob Stokes has correctly acknowledged in a private member’s statement in the Legislative Assembly that the report “relies heavily on evidence provided by the Urban Taskforce … using a contested methodology to produce findings that are both superficial and misleading”.

And then there is this snippet from another equally powerful article on our pages that debunks the myth of inadequate speed on development approvals.

Housing supply in Sydney is a success story with the city having the highest housing approvals in the developed world – a product of the established planning system (not of course without its flaws but by no means the block or barrier to development it is painted as.

Yet despite the evidence most observers say very little by way of refuting he deception of the single-minded simplistic mantra that has dominated public discourse and gone unchallenged for decades now.

Not Peter Phibbs. In his short presentation for the festival Phibbs was able to not just nail an alternative view – but bolt it into place.

What was happening even in the public service, he said was “structured misrepresentation”.

“In other words lying”.

It goes like this, he said: Prices rise, people worry, social housing advocates get louder and the government finally decides to hold an inquiry.

“And the response is very predictable: after 20 years they say the same thing: the only problem is red tape, taxes and planning regulations.

“The federal agencies say it’s land supply. The RBA says it’s nothing to do with us and the Grattan Institute blames NIMBYs.”

The whole thing ends up with blame heaped on local government, he says.

“The main thing among politicians is to sound concerned, blame someone else and do nothing.”

They do nothing because they’re terrified about the prices falling and because most voters are home owners.

And as we’ve said countless times developers purport to want lower prices but if the prices fall they immediately stop building. Besides check the landbanks they own, all approved for housing.

Phibbs tips that nothing will change until most voters are renters.

The development lobby blames policy failure. But that’s not true either,

“I don’t think we’ve had policy failures; the system has operated exactly the way people have wanted it to behave.”

What’s intolerable Phibbs says is when public servants fall into the same trap and engage in deceptive data manipulation.

The NSW productivity Commission for instance. In a report from the commission that came out in May this year one of its graphs, 7.2, shows supply not keeping up with needs.

The data starts at 2006 and “we can see a shortage of housing”.

“The underlying narrative is that planning must be busted because there is so much a shortage of housing over a period of time.”

The trouble is the commission doesn’t say how they constructed the graph.

“They don’t tell you the source documents so that’s a bit of a concern.”

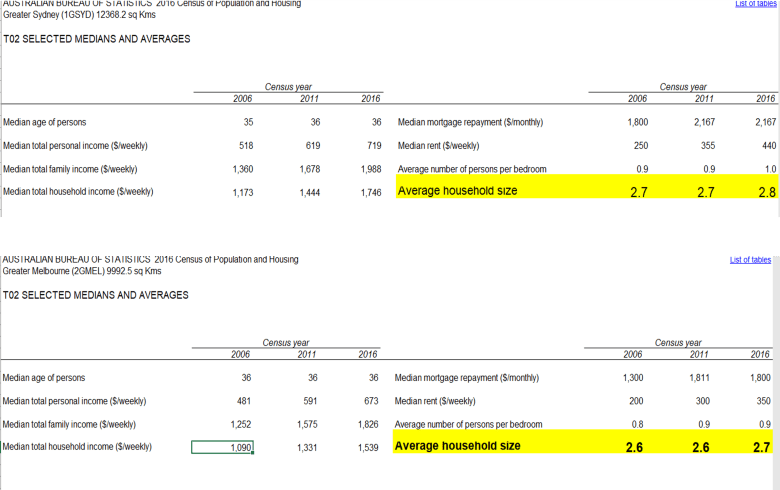

A major problem easy to detect though is that the graph uses old 2006 person per household numbers, while in fact we know that the number of persons per household has increased, which is not surprising, Phibbs says, because the cost of housing has gone up so people defer creating their own households.

This skews the results “If we’d use the 2016 number instead of a shortage, we’d see there’s been a surplus for a large part of the graph.”

Another problem is the report ignores the huge surge in dedicated student housing in both Melbourne and Sydney and because kitchens are shared the accommodation is simply excluded from the count of dwellings. Student numbers though are counted in the population data.

Accommodation where bedrooms are carved out of a lounge room and used by short term immigrants to save on rent, is also ignored.

And there’s more. “They ignore that half the population is coming from natural increases and that a lot of people when the family gets bigger simply renovate and extends the dwelling. So that’s not counted. And again helps push the narrative.”

Data from Tim Toohey, chief economist with fund manager Yarra Capital and previously Goldman Sachs counters all this with data that shows there was a surplus of housing in the 2002 to 2006 period and he predicts a “substantial surplus of stock” in the next few years because of Covid related reasons.

“They make things up,” Phibbs says. The commission shows purportedly ABS data that residential private building approvals decreased by 44 per cent across the nation from 2016 – 2020 compared to the previous five-year period.

“The only trouble is that instead of being a 44 per cent decrease there was actually a 10 per cent increase.”

Proving they engaged in “strategic misrepresentation, otherwise known as lying.”

The new government housing inquiry by led by MP Jason Falinski came in for a serve as well, and to be fair it’s come in for a serve from a growing number of sources who are all concerned that Falinksi appeared to decide the problem was supply before the inquiry had even started.

Supply is one item in housing and planning complexity. But it’s so simplistic it’s almost laughable. Imagine deregulating zoning like the Reserve Bank has called, echoing the productivity commissions NSW and federal.

Imagine this happened and developers were unleashed, building wall to wall towers or big box retail and factories wherever they liked. Prices would soon fall of course, because only low income people would choose to live there.

The thing is that planning and housing is not a factory delivering widgets where equilibrium between supply and demand is a beautiful thing. It’s about our quality of life and designing the world we want to live in, no less than that.

There is so much more involved in housing prices too.

Tax policies are crucial. Capital gains tax discounts on our own homes and investment property is probably the biggest incentive driving the bubble now that rates are so low and so few people need to negatively gear.

There’s also the dominant ideology that abhors government housing and thinks the private sector is the way to go – where it must be said all the intermediaries can “clip the ticket”. ts. Victoria has drawn a line in the sand with its announcement of $5 billion plus in social housing but according to the experts that’s a drop in the bucket.

Meanwhile 1 million people in Australia are struggling with huge housing costs. As Robert Harley pointed out in The AFR last week, there is “more than a million low-income Australian households struggling in private rental accommodation.

“The average Australian household spent 14 per cent of its income on housing in 2017-18 according to the Australian Institute of Health and Welfare. But those on the lowest 40 per cent of incomes in private accommodation paid on average 32 per cent of their income for their homes, which puts them well into financial housing stress.”

Phibbs’ analysis and that of so many others we’ve touched on signal that it’s time to turn the tide on this debate.

Enough with denial and misdirection as to the solutions. This is all a bit too much like the battles from climate deniers.

On the panel Core Logic’s Eliza Owen, well known housing analyst in the public forum, said that as a Millennial she and her cohort are probably living the lifestyle they can afford now but what they might not expect is that if they don’t own a house by retirement they could be in for significant stress.

The ACT government’s Dr Erin Brady who completed her PhD under Phibbs’ supervision would like to have a better understanding and discussion of planning.

But how? asked Nicole Gurran, in the hope perhaps we could get more rational outcomes from a more collaborative approach between the skilled developers who deliver the places where we live, work and play, the politicians and planners who must make the tough decisions to allocate our scarce resources and we the people who stand to win or lose from the results.

To be truthful, it could start by that: stop telling lies.

I believe taxes on developing land and building and charges in NSW are 64% of the cost of a house and in WA are 40+ % . Yes some are necessary but some are just a rort. So if we can reduce stamp duty and the like we improve affordability

Oh dear me… the emperor is starkers and the court are commenting on his sandals. Housing prices are the result of demand being above supply – a deliberate policy created by high immigration , baby bonuses and inviting anyone in the world to invest in our property market.

Excellent summation of Peter’s talk. Thank you. It was good to hear both you and Peter say it like it is, Tina. This type of rhetoric and alternative facts have also played a big role in NSW Govt refusing to adopt the changes to the NCC next year for basic access features in all new homes. In 2010 industry agreed these features are important, doable and cost effective. That’s how the Livable Housing Design Guidelines were born. But nothing happened. The Building Ministers’ Meeting agreed to mandate these features in April this year and so the features will be in next year’s NCC. Although VIC, QLD, TAS, NT, ACT and WA (with a bit more time) are ready to roll, the industry is still fighting on for NSW not to follow suit. I fail to see why.